Before we address how to start your investment journey and create your first portfolio, we need to understand why you need to invest in the first place. To better understand the need of investment, we would look at what would happen if we don’t invest a single amount of money.

Why to Invest?

Let’s assume there are two boys – Sam and Hari. Both works in the same IT company and both earn Rs. 50,000/month, and spend Rs. 30,000 towards their cost of living, housing, food, transport, shopping and other needs that you can come up with. The balance of Rs. 20,000 is their monthly surplus.

Hari decides not to invest a single penny in stocks, mutual funds, bonds or any other types of investment, while Sam decides to invest a fixed amount of money regularly until his retirement.

For the sake of simplification let’s ignore the effect of personal income tax for a moment in this discussion. To make things simpler we will take a few assumptions.

- The employer is kind enough to give them a 10% salary hike every year.

- The cost of living is going to increase by 8% a year.

- Both are 30 years old and plan to retire at 50. This leaves us with 20 more years to earn.

- They don’t intend to work after their retirement.

- Their expenses are fixed and don’t foresee any other new expenditures

- The balance cash of Rs. 20,000 per month is retained in form of hard cash.

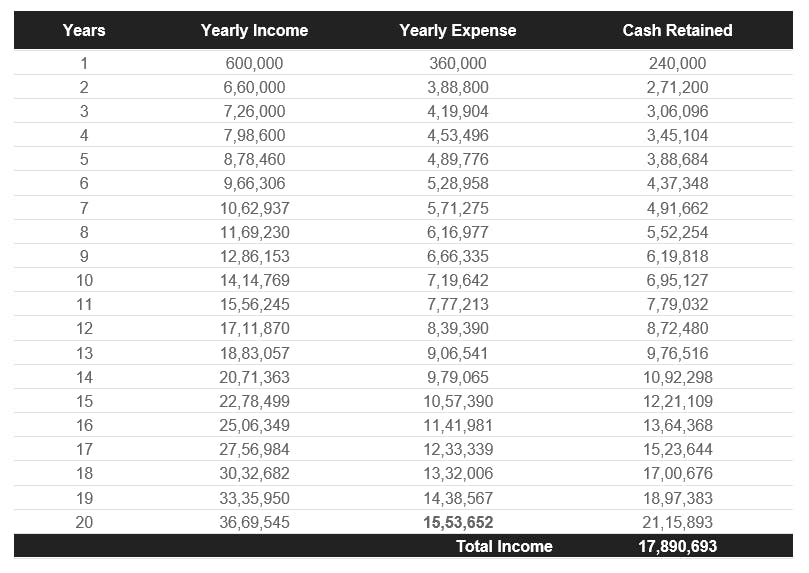

Going by these assumptions, here is what Hari’s cash balance will look like in the next 20 years.

If you analyze these numbers, you would soon realize this is a scary situation for Hari.

- After 20 years of hard work, Hari would have accumulated Rs. 1.7 Crore rupees, which might sound good in the first place but will be proven as a scary place to be in.

- Since Hari’s expenses are fixed, his lifestyle hasn’t changed much over the years, he probably even suppressed his aspirations of having a – better home, better car, vacations etc.

- After he retires, Hari’s expenses would still continue to grow at 8% of interest which we assumed earlier. With Rs. 1.7 Crore Hari would be good enough to sail through 8 years of his post-retirement life. 8th year onwards he will be in a very tight situation with literally no savings to backup and no active source of income.

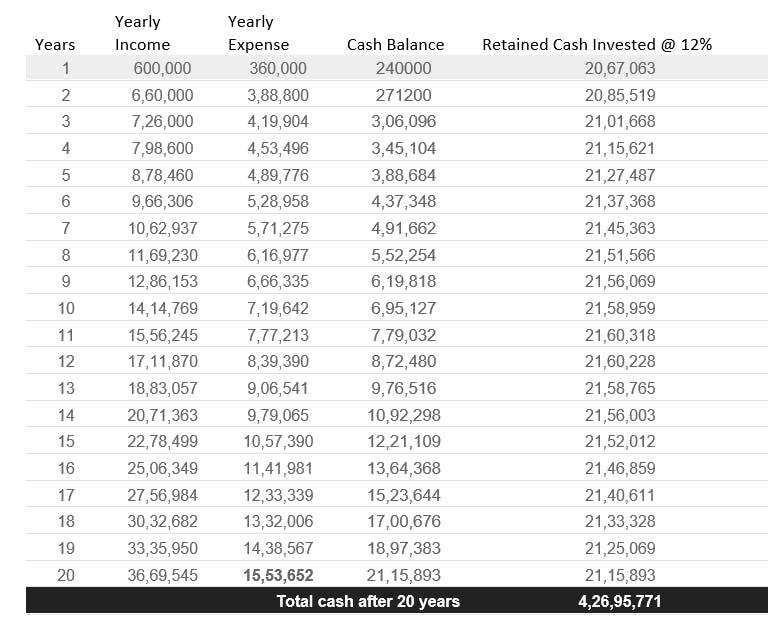

Let’s consider Sam’s scenario now, where instead of sitting ideally, he chose to invest the cash in an investment option that grows at let’s say 12% a year. For eg. In the first year, Sam retained 2.4 Lac of hard cash and invested it all in an option which gave him a 12% return every year. Over the next 20 years, it yields roughly Rs. 2,067,063/- at the end.

With the decision to invest the surplus cash, Sam’s cash balance has increased significantly. The cash balance has grown to Rs. 4.26Crs compared to Hari’s cash balance of Rs.1.7Crs. This is a staggering 2.4x times. This translates to Sam being in a much better situation to deal with his post retirement life.

Now, going back to the initial question of why invest? There are a few compelling reasons for one to invest.

- Fight Inflation – By investing one can deal better with the inevitable – growing cost of living – generally referred to as Inflation

- Create Wealth – By investing, one can aim to have a better corpus by the end of the defined time period. In the above example, the time period was up to retirement, but it can be anything – children’s education, marriage, house purchase, retirement holidays, etc

- To meet life’s financial aspirations.

Where to Invest?

Having figured out why to invest, the next obvious question would be where would I put my money and what are the returns I could expect by investing.

When it comes to investing, one has to choose an asset class that suits his risk profile and returns expectations.

An asset class is nothing but a simple category of investment with particular risk involved and return characteristics. The amount of risk involved and returns to expect both varies by each asset class.

The following are some popular asset classes.

- Fixed income instruments

- Equity

- Real estate

- Commodities (precious metals)

Fixed Income Instruments

These are investable instruments with minimal risk to the principle, and the return is paid as an interest to the investor based on the particular fixed-income instrument. The interest paid could be quarterly, semi-annual or annual intervals. At the end of the term of deposit, (also known as maturity period) the capital is returned to the investor.

Typical fixed income investment includes:

- Fixed deposits offered by banks.

- Bonds issued by the Government of India

- Bonds issued by Government related agencies such as HUDCO, NHAI, etc.

- Bonds issued by corporates

As of June 2014, the typical return from a fixed income instrument varies between 8% and 11%.

Equity

Investment in Equities involves buying shares of publicly listed companies. The shares are traded on the Bombay Stock Exchange (BSE), and the National Stock Exchange (NSE).

When an investor invests in equity, unlike a fixed income instrument, there is no capital guarantee. However, as a trade-off, the returns from equity investment can be quite handsome. Indian Equities have generated returns close to 14% – 15% CAGR (compound annual growth rate) over the past 15 years.

Investing in some of the best and well run Indian companies has yielded over 20% CAGR in the long-term. Identifying such investment opportunities requires skill, hard work, and patience.

Taxation on Equity investments held for more than 365 days is taxed at 10%, if the gains are more than Rs 1 lakh starting from 1st April 2018 (previously such investments were tax-free). This is comparatively a lower rate of tax than the other asset classes.

Real Estate

Real Estate Investment involves transacting (buying and selling) commercial and non-commercial land. Typical examples would include transacting in sites, apartments and commercial buildings. There are two income sources from real estate investments, namely – Rental income, and Capital appreciation of the investment amount.

The transaction procedure can be quite complex involving legal verification of documents. The cash outlay in real estate investment is usually quite large. There is no official metric to measure the returns generated by real estate. Hence it would be hard to comment on this.

Commodity – Bullion

Investments in gold and silver are considered one of the most popular investment avenues. Gold and silver over a long-term period have appreciated. Investments in these metals have yielded a CAGR return of approximately 8% over the last 20 years.

There are several ways to invest in gold and silver. One can choose to invest in the form of jewelry or Exchange Traded Funds (ETF).

Going back to our initial example of investing the surplus cash it would be interesting to see how much Sam would have saved by the end of 20 years considering he can invest in any one – fixed income, equity or bullion.

- By investing in fixed income at an average rate of 9% per annum, the corpus would have grown to Rs.3.3Crs.

- Investing in equities at an average rate of 15% per annum, the corpus would have grown to Rs.5.4Crs.

- Investing in bullion at an average rate of 8% per annum, the corpus would have grown to Rs.3.09Crs. Clearly, equities tend to give you the best returns, especially when you have a multi-year investment perspective.

Conclusion

By now you would have known the importance of why do you need to invest. While we have discussed about why to invest and where to invest, we haven’t yet discussed how to invest which would be covered in next post where I will be creating multiple portfolios for different personas.

Meanwhile here are some reasons why you should diversify your investments, though we are going to look into it deeply in the next post.

Investments optimally should have a strong mix of all asset classes. It is smart to diversify your investment among the various asset classes. The technique of allocating money across assets classes is termed as ‘Asset Allocation’.

For instance, a young professional may take a higher amount of risk given his age and years of investment available to him. Typically, investors should allocate their money into different classes dependent on their age. While you may listen “age doesn’t matter” in every other field, it does matter in terms of investment. Your age can provide your risk tolerance and can guide you better at managing your portfolio and investments.

That’s all about this post. Stay tuned for the next post where we will create different portfolios for 3 different investors all coming from different areas of life so you can better understand how to create yours, depending on your age, background and risk appetite.